Export Cars from China: A Comprehensive Guide for B2B Importers

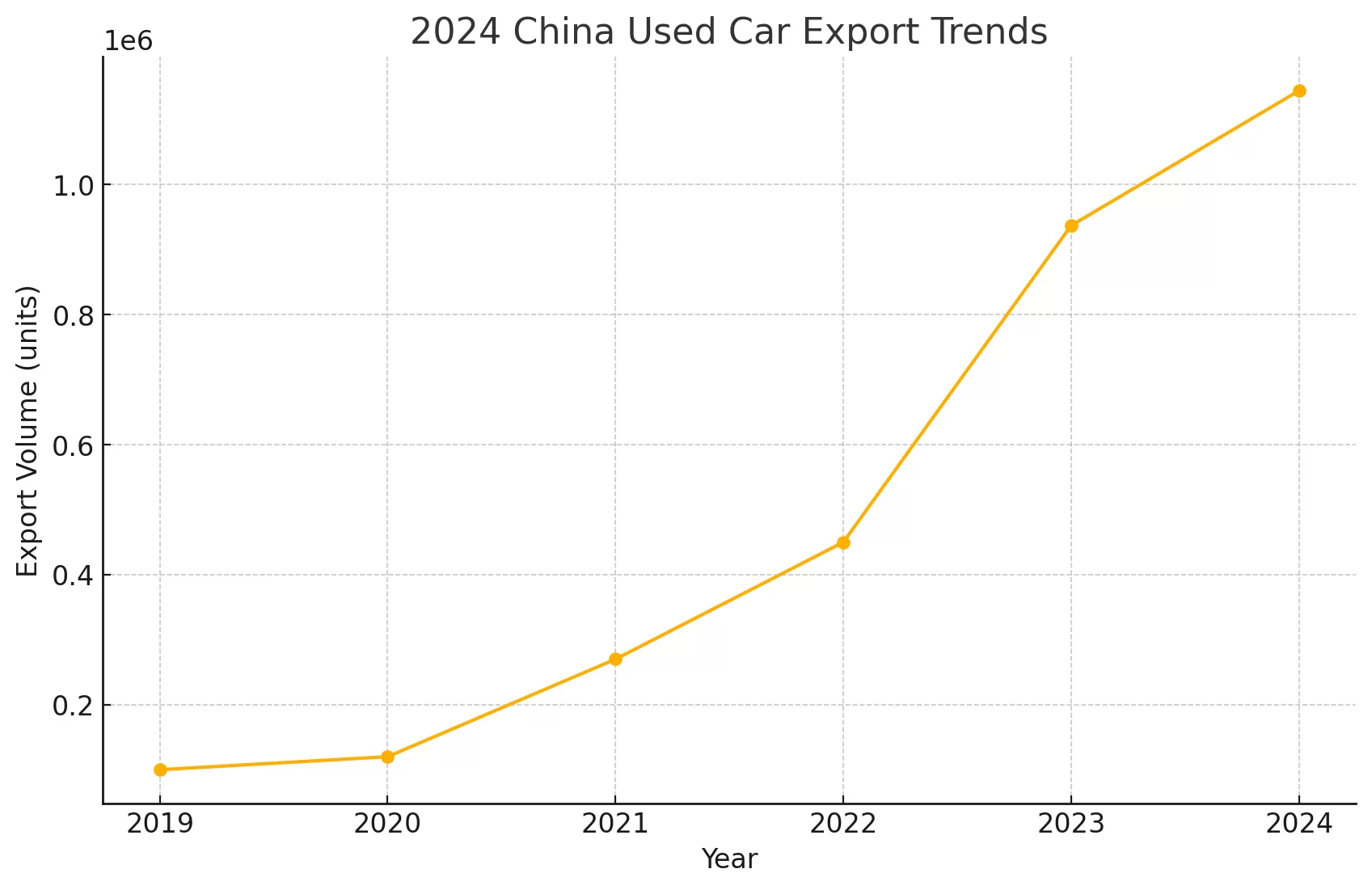

China shipped 6.41 million vehicles worldwide in 2024—a 23% year‑on‑year increase—reinforcing its role as the top global auto exporter. Electric vehicles alone accounted for 1.2 million exports (32% of the total), driven by competitive pricing and robust supply chains. B2B importers must navigate evolving regulations, logistics bottlenecks, and partner selection to capitalize on this market. Below, industry experts share key strategies, and Figure 1 illustrates the rapid growth of used‑car exports over the past six years.

Global Car Export Trends and Market Dynamics

Rapid Growth of EV and Used‑Car Exports

China’s EV exports soared to 1.2 million units in 2023, up from 450 k in 2022 and 270 k in 2021 . Used‑car exports jumped from 270 k in 2021 to 937 k in 2023, reflecting rising global demand for affordable quality .

Emerging Destination Markets

Southeast Asia, the Middle East, and Africa now account for over 55% of Chinese auto exports, as these regions seek cost‑effective mobility solutions.

Common categories of vehicles imported from China include:

- Conventional passenger and commercial vehicles, such as sedans, SUVs, and trucks.

- Premium luxury models from high‑end brands like Mercedes‑Benz, BMW, and Audi.

- New energy vehicles, covering both battery‑electric and plug‑in hybrid cars that often benefit from preferential tariffs or subsidies.

Special‑purpose vehicles designed for specific tasks, including construction machinery, fire engines, ambulances, buses, and excavators.

Regulatory Landscape: Compliance is Key

Import regulations vary significantly. For example, Russia imposed new recycling fees in early 2024, adding €500–€2,000 per vehicle . Meanwhile, Canada’s 100% tariff on Chinese EVs came into effect in August 2024 to counter perceived state subsidies .

Logistics & Supply‑Chain Considerations

Port Congestion and Container Shortages

Some Chinese EVs have been stranded in European ports for 12–18 months due to storage backlogs and container imbalances .

Choosing the Right Car Export Partner

Factors to evaluate:

Track Record & Volume: Look for exporters handling >100,000 units/year.

End‑to‑End Services: Sourcing, inspection, documentation, shipping, and after‑sales.

Local Presence: Overseas warehouses in key markets reduce lead times.

Payment Methods & Risk Mitigation

Secure options include:

Letter of Credit (L/C): Guarantees payment upon document compliance .

Telegraphic Transfer (T/T): Widely used for reliability and traceability.

Escrow Services: Funds released upon delivery confirmation.

Implement trade credit insurance and clear contractual terms to further minimize risk.

Hot News

Industry information

Silu car exporter provides high -quality products and services

December 04, 2023

In November, China's automobile exports increased by 1.3% month on month and 18.6% year-on-year

December 27, 2023

Guiyang Silu invites you to visit our Thailand exhibition

September 12, 2024

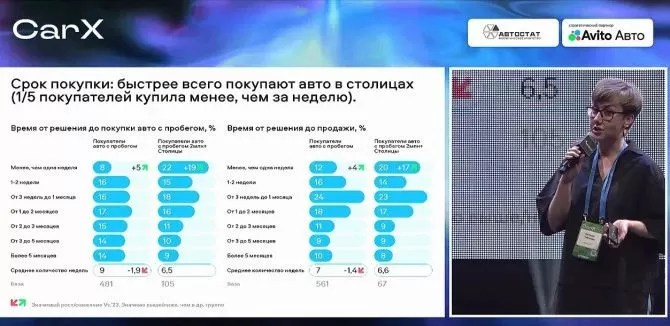

Russian used car buyer investigation: prefer car age 4-5 years

October 24, 2024

The United States lifts sanctions on 11 Russian banks

November 14, 2024

Which platform is reliable for buying used cars?

December 04, 2024

EN

EN RU

RU

AR

AR

FR

FR

PT

PT

ES

ES

FA

FA

VI

VI

KK

KK

LA

LA

KM

KM

LO

LO

JA

JA