The Frenzy and Calm Before the New Policy for Used Car Exporters in China at the End of 2025

This is not the usual year-end promotional season, but a crucial window of opportunity before the implementation of the new policy for used car exports. With the official implementation of the "Notice on Further Strengthening the Management of Used Car Exports" jointly issued by four ministries on January 1, 2026, the entire industry is exhibiting a complex mix of sprint and observation, expansion and regulation in this final month.

I. The Sprint in Progress: Car Dealers in Many Regions Rush to Take Advantage of the Policy, Export Channels Flourish

In December, from inland to coastal areas of China, a surge in used car exports is evident everywhere. Car dealers are racing against time to meet deadlines, not only to boost annual performance but also to circumvent the new policy's control over "0-kilometer used cars," seizing the last opportunity to sell off their inventory.

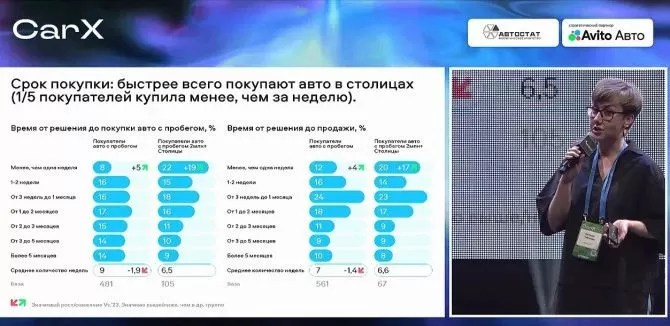

Industry data confirms this surge in demand. According to the weekly used car report, from December 8th to 14th, the national average daily transaction volume of used cars reached 69,500 vehicles, a 3.05% increase compared to the previous week. This represents a cumulative increase of 6.5 percentage points for two consecutive weeks in December, with particularly significant increases in transaction volume in export-oriented regions such as East China and Central South China.

II. The Eve of the New Policy: Calm and Transformation Amidst the Frenzy

The year-end export frenzy was more like a "warm-up" adaptation to the new policy. Following the release of the new policy by four ministries in November, core requirements such as "strictly controlling the export of new cars under the guise of used cars" and "establishing a dynamic management mechanism for enterprises" prompted many companies relying on "zero-kilometer used cars" for export to urgently adjust their business structures.

The new policy clarifies that from January 1, 2026, vehicles exported within 180 days of their registration date must submit a supplementary "After-Sales Service Confirmation Letter" from the manufacturer. This directly closes the gray area of "exporting new cars immediately upon registration."

Driven by the new policy, enterprises are transforming not only in terms of vehicle sourcing structure but also extending to the entire industry chain layout. The platform has aggregated resources across the entire industry chain, including finance and insurance, inspection and preparation, and logistics. It has also established a special committee for exported used cars to strengthen industry self-regulation and promote economies of scale among enterprises.

However, the pain points in the transformation process have not been fully resolved. Many car dealers report that logistics companies are generally unwilling to transport used electric vehicles because they are classified as dangerous goods; domestic used car consumer loans and financial services are difficult to obtain; and issues such as the implementation of tax refund policies and the connection with overseas warehouse financing have long plagued the industry. These are precisely the areas where the industry needs to focus its efforts after the implementation of the new policy.

III. Looking to the Future: The "Breakthrough" for China's Used Car Exports

The implementation of the new policy marks the end of China's "wild growth" in used car exports and the beginning of a new stage of standardized and high-quality development. From a global market perspective, China's used car exports are facing competitive pressure from countries such as Japan and South Korea, but also possess vast potential for growth.

Data shows that from January to November 2025, South Korea's used car exports surged to $8.4 billion, a year-on-year increase of 82.6%. Japan, as the leading used car exporter, saw its exports exceed 800,000 vehicles for the first time in the first half of 2025, with the African market accounting for 36%. The experiences and shortcomings of Japan and South Korea offer important lessons for China.

Japan's stringent quality certification system, mature auction model, and comprehensive overseas service network have earned its used cars a strong reputation in the global market. South Korea, on the other hand, relies on price advantages to boost sales in emerging markets, but suffers from shortcomings such as lack of certification and weak infrastructure. In comparison, China's used car exports have the potential for explosive growth exceeding 200% annually and have begun to establish their own quality certification standards, but still lag behind in areas such as overseas service systems and vehicle model optimization.

Looking ahead, breaking through the current bottleneck in China's used car exports requires efforts in three directions: First, leveraging the new policy opportunity to improve industry standards, establish a unified national quality certification system, and enhance the global credibility of Chinese used cars; second, optimizing the vehicle model structure, seizing the opportunity presented by the growing global demand for green mobility, and expanding the export share of used new energy vehicles; and third, strengthening collaboration across the entire industry chain, relying on integrated service platforms to promote the internationalization of supporting services such as logistics, finance, and after-sales service, and establishing forward warehouses and repair stations in key overseas markets to address the concerns of overseas consumers.

The busy figures of used car dealers in the last month of 2025 are both a summary of the rapid growth of the past few years and an early preparation for the new era of standardized development. The new policy is not an obstacle to the industry, but rather an outlet for high-quality development. With the continuous improvement of the competitiveness of China's automotive industry, used car exports are expected to become a new growth engine for foreign trade and occupy a place in the global used car market.

Hot News

Industry information

Silu car exporter provides high -quality products and services

December 04, 2023

In November, China's automobile exports increased by 1.3% month on month and 18.6% year-on-year

December 27, 2023

Guiyang Silu invites you to visit our Thailand exhibition

September 12, 2024

Russian used car buyer investigation: prefer car age 4-5 years

October 24, 2024

The United States lifts sanctions on 11 Russian banks

November 14, 2024

Which platform is reliable for buying used cars?

December 04, 2024

EN

EN RU

RU

AR

AR

FR

FR

PT

PT

ES

ES

FA

FA

VI

VI

KK

KK

LA

LA

KM

KM

LO

LO

JA

JA